Explain Difference Between Zakat and Ushr

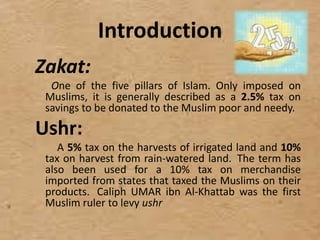

The authors claim that the rates defined for zakat in Quran are actually defined for al-sadqas and hence zakat payment scale is relative and can be changed over time. Only imposed on Muslims it is generally described as a 25 tax on savings to be donated to the Muslim poor and needy.

Unit02 Zakat Ushr And Inheritance

Authors highlight the difference between al-zakat and infaq.

. Zakat Ushr 1 1. Answer 1 of 1. There is difference between Zakat and tax in respect of the utilisation of respective fund whereas tax can be spent for any purpose.

You wish to pay Zakah in the form of money or. Explain the status of woman as a competent witness under Islamic Law of Evidence. Distribution of wealth like Zakat Ushr Charity and Inheritance should be properly applied.

It was a tax collected by the. His needs that person is required to pay a. One of the five pillars of Islam.

Define and discuss the concept and theory of Jehad War in the light of Islamic International Law. The Ordinance and the rules made thereunder provide for the items. Subsequently Zakat and Ushr Ordinance 1980 was promulgated on June 20 1980.

Ushr Ordinance even though the Muslim citizens pay other taxes such as income tax sales tax import tax. Ushr becomes obligatory when a beliver has land that produces fruitscrops etc. The same provision has been made in Zakah Ordinance of Bangladesh though Zakah payment here is optimal.

Zakat is officially and obligatorily collected at 25 on 11 assets determined in the 1980 Zakat and Ushr Ordinance under Schedule One. 25 rupees for every hundred rupees as Zakah. District Zakat and Ushr Committees are responsible for exercising control over the affairs of the District and Local Zakat Committees.

Their legal proof is what the Messenger PBUH had said On a land irrigated by rain water or by natural water channels or if the land is wet due to a near by water channel ushr ie. In the form of gold or silver zakat al mal If you wish to pay Zakah in the form of money following is the easiest calculation. And on the land irrigated by the well half of an ushr ie.

In addition to the required alms Muslims are encouraged to give in charity at all times according to their means. Zakat is a compulsory tax which is imposed on the wealthy Muslim people for providing social justice to the community. The kharaj was a land tax that was originally paid only by non-Muslims whereas Muslims had to pay the ushr -- a religious tithe.

Only imposed on Muslims it is generally described as a 25 tax on savings to be donated to the Muslim poor and needy. One-tenth is compulsory as zakah. I ask Allah to make this a sincere effort seeking his pleasure and I ask him to grant us refuge in him.

However Zakah paid is deducted from total income liable to income taxation. Explain briefly the sources of revenue of an Islamic state. If this is done there is no reason that we will not observe a significant positive change.

Islamic taxes are taxes sanctioned by Islamic law. - a Master budgeting - b Variance analysis - c Activity based costing - d Investment appraisal - Cost Accounting Multiple Choice Question- MCQtimes. A Zakat district normally corresponds to a civil district in the country however in the big cities two Zakat districts have been created.

Posted at Dec 042010 0423PM. The apparent consensus follows from the fiqhi prescription of imposing zakat on urud al-tijarah or the. Islamic taxes include zakat - one of the five pillars of Islam.

Explain briefly the Hudood crimes. Solved Answer of MCQ What term can be defined as a means of assessing the difference between a predetermined amount and the actual amount. The authors discuss the claims made regarding its sufficiency in an Islamic economic system.

A term used in Islamic finance to refer to the obligation that an individual has to donate a certain proportion of wealth each year. PurposeAvailable zakat accounting standards as well as the laws governing business zakat suggest that the adjusted net working capital or the adjusted growth capital of a business may be regarded as the base for computation of its zakat liability. The word zakat means purity development blessings and praise but in practice it refers to alms - money or food that is given to the poor 1.

When a Muslim persons earnings reach a prescribed amount called nisab in excess of. And Allah alone knows the best. On the completion of the year of Zakah find out their price and then pay its 25 ie.

Therefore a portion of our wealth is set a side for the deserver which are called zakat. However this does not mean that use of any other mode of trade and business except from Mudarabah and Musharakah is totally disallowed by Shariah. Ushr means in Arabic one tenth that is one tenth of the harvest should be given to the poor if the harvest is realized without irrigation.

Zakat is meant to be spent for specified objectives which are mainly provision for the poor poverty alleviation to free debtors from the debt to free the people in bondage for the way farer and for the good of the people ie. Define and distinguish between Hadd and Tazir crimes. The word zakat means purification and cleanliness it is the purification of soul character and wealth.

One-twentieth is compulsory as zakah44 This madhab depends also on what Allah SWT says and palm. Zakat al-mal or zakah al maal can be defined as the obligation upon every Muslim man and woman having certain amount of wealth kept for a lunar year to pay a certain amount to deserving people. Eventually however the term.

A 5 tax on the harvests of irrigated land and 10 tax on harvest from rain-watered land. There are 115 Zakat districts in total. Zakat is a form of worship which involves wealth.

Additional voluntary charity is called sadaqah from an Arabic word meaning truth and honesty Sadaqah may be given at any time and in any amount while Zakat is typically given at the. The zakah and ushr system in Pakistan was introduced through Zakat and Ushr Organisation Ordinance 1979 issued on June 24 1979 for the establishment of zakah organisations at national provincial district subdistrict and local villageward levels. They are based on both the legal status of taxable land and on the communal or religious status of the taxpayer.

The kharaj and ushr were two forms of taxation by which the Muslim authorities extracted revenue from their subjects. Zakat al-Mal Definition. All other assets fall under Schedule Two which are not subject to zakat and fall under donations by the goodwill of an individual.

New Zakat Ushr Law 2010 Provincial Assembly Of Punjab The principal taxes were the tithe on the produce of the land called ushr and the zakat fortieth on merchandise and cattle.

Following Is The Difference Between Tax And Zakat Pdf Umar Taxes

Comments

Post a Comment